Nickel, often recognized as the very first French neobank, offers a unique model – a nearby payment account that resembles a traditional bank, rather than the full banking experience. But beyond its accessibility, is Nickel a worthwhile choice against the rest of the banking offers in the US?

Features of Nickel

| Characteristic | Description |

|---|---|

| Opening Bonus | None |

| Income Condition | None |

| Banking Card | Mastercard |

| Initial Deposit | None |

| Account Maintenance Fee | None |

| Referral Program | Yes |

| Application | Android/iOS |

| Mobile Payment | None |

| 3D Secure | Yes |

Nickel in Brief

Nickel is a French neobank established in 2014 by the Financière des Paiements Électroniques (FPE) and its founders, Ryad Boulanouar and Hugues Le Bret, respectively electronic and finance engineers. Their primary goal was to provide each customer with an affordable bank account within minutes, activated at the nearest tobacconist, without deposit or income conditions. Primarily targeted towards individuals with banking prohibitions, students, precarious individuals, or even those undergoing a divorce and needing a simple backup account. All this is made possible thanks to swift opening at any partner tobacconist. Today, Nickel boasts over 2 million clients from diverse backgrounds, even if they don’t reside in the US (over 160 countries).

Nickel’s unique feature is that it’s a payment institution; it can’t speculate with its clients’ money like a conventional bank. Nickel and FPE were acquired in 2020, with BNP Paribas Group owning 95% and the Confederation of Tobacconists holding a minority stake (5%).

Nickel’s Pricing

Nickel doesn’t offer a free account, but the basic subscription is very low: $20 per year for account access, equivalent to $1.6 per month. The Nickel account provides a standard Mastercard. Nickel is very transparent about its fees and does not offer any hidden charges, although they are relatively numerous and costly in the context of a basic account:

| Account Type | Nickel | My Nickel | Nickel Chrome | Nickel Metal |

|---|---|---|---|---|

| Card Fees | $20/year | $22.50/year | $50/year | $100/year |

| Initial Deposit | None | None | None | None |

| Income Conditions | None | None | None | None |

| Withdrawal Fees in US and SEPA zone | $1.5 per operation (in US)

$1 per operation (outside US) 3free withdrawals at tobacconists and Nickel Points. The rest remain at a rate of $0.5/withdrawal |

Similar to Nickel | Similar to Nickel | Free in US and SEPA zone

3 free withdrawals at tobacconists and Nickel Points. The rest remain at a rate of $0.5/withdrawal |

| Foreign Payment (Outside SEPA zone) | $1 per operation | $1 per operation | No fee | No fee |

| Foreign Withdrawals (Outside SEPA zone) | $2 per operation | $2 per operation | $1 per operation | Free |

| Payment Ceiling | $1,500 – $3,000/month | Similar to Nickel | Similar to Nickel | Similar to Nickel |

| Withdrawal Ceiling | $300 – $800/week | Similar to Nickel | Similar to Nickel | Similar to Nickel |

My Nickel, Chrome, and Metal accounts, respectively costing $22.50, $50, and $100 per year, may not seem essential, even for a primary account, outside of Mastercard insurance. This is primarily due to their benefits not differing significantly from the basic offer.

Additional fees are applicable to all accounts. For instance, account top-ups by credit card from the client space incurs a fee (2% of the amount), check deposits (3 USD per deposit), and surprisingly, exceeding 60 SMS alerts per year ($1 for every additional 10 SMS). Depending on the usage of the Nickel account, these fees can have a significant impact on the banking experience.

Funding Your Account

Like almost all neobanks, Nickel allows you to fund your account from any external account using IBAN, with no maximum limit. However, you can’t register an external account for quick transfers: these take an average of 24 to 48 hours.

In addition to transfers, it’s possible to cash checks from the app via a handy dedicated system. However, the collection time can be very long, taking up to 15 working days.

Lastly, you can also fund your account with cash directly at a partner tobacconist. However, be aware that this operation incurs fees: 2% of the deposited amount and capped at $950 cumulatively over 30 calendar days. However, the balance is added in real-time to the account.

Opening an Account with Nickel

Nickel promises an account + card + IBAN in 5 minutes. While one could quibble about the timing, it’s true that Nickel delivers on its promise. However, two steps are added to the process. The first validation takes place on the site with the provision of a two-sided ID photo, some personal and professional information, and verification via webcam or smartphone camera.

The second step involves going directly to a tobacconist or partner sales point of the bank for the final account opening. After providing your ID and the $20 for the first subscription, the tobacconist prints the card of your choice, an operation that only takes a few minutes.

Then, simply go to the bank’s web platform or the application and enter the identifiers located on the back of the card.

Nickel also has an offer dedicated to teenagers aged 12 to 18 years and includes a systematic authorization standard Mastercard, all offered for $20 per month and controllable by parents via the app.

Initial Deposit and Overdraft Management

Nickel does not require an initial deposit for any of its accounts. Therefore, you can use the account once it’s created at your tobacconist without having a balance.

However, Nickel accounts can’t be in deficit. Therefore, it’s impossible to get an overdraft authorization. If a payment exceeds the account balance, the payment will simply be declined.

Welcome Bonuses

As Nickel is not a typical neobank and certainly not an online bank, it does not offer any kind of welcome bonus for account opening.

However, Nickel doesn’t skimp on solidarity operations, especially during this pandemic period. The bank recently made a gesture for its individual customers and partners, notably by offering a Nickel Chrome card to tobacconists in its network and to health personnel.

Referral Bonus

Nickel’s referral offer allows customers to earn a bonus when they recommend the online bank to their loved ones. Everything is done via a referral code system available from the customer area. For each referred friend, the referrer gets $3:

1 friend = $3 2 friends = $6 5 friends = $15 15 friends = $45

The bank also doesn’t set any limits, so it’s theoretically possible to earn up to $3000 for 1000 referrals.

Insurances and Services at Nickel

Accounts at Nickel are linked to Mastercard. Thus, its customers are dependent on the insurance package associated with the chosen card level. Note that the basic Nickel account does not offer additional insurance, only the Nickel Chrome and Nickel Metal cards do. The first offers a standard travel insurance policy (flight delay, loss of baggage, etc.), in case of theft of material and for fraud when purchasing on the internet. But it’s with the Nickel Metal card that the exclusive insurances are most numerous, thanks to the contribution of Europ Assistance for travel in addition to the guarantees included with the corresponding Mastercard.

Nickel also has a partnership with RIA allowing its customers to send money very simply and from the application to more than 150 countries. The service works flawlessly with perfect integration and with the corresponding currency to the receiving country.

Cashback

Since December 2020, Nickel has offered a cashback system allowing you to get a percentage of reimbursement on purchases made via partner brands, in-store or online. It’s not a platform owned by the bank, but just the integration of the Mastercard body’s platform called “Travel Rewards“. This program will therefore only be of interest to globetrotters and wealthier customers making purchases at one of the partner establishments. None of them are located in the USA: it mainly concerns luxury shops and restaurants.

It feels like this cashback program has been added to inflate the list of services without really being of interest to the bank’s main target.

Customer Service

From the app, you can access Nickel’s support directly via chat, email, or by calling. However, the availability of advisors can vary depending on the time, which can be very problematic when traveling abroad. However, responses are personalized and the tone is friendly. You can also get assistance from the bank’s social media like Twitter (X) or Facebook, which is more responsive.

And Cryptocurrency?

Nickel is not a bank designed for cryptocurrency investors or any speculative values. Therefore, no support in this area can be attributed to it.

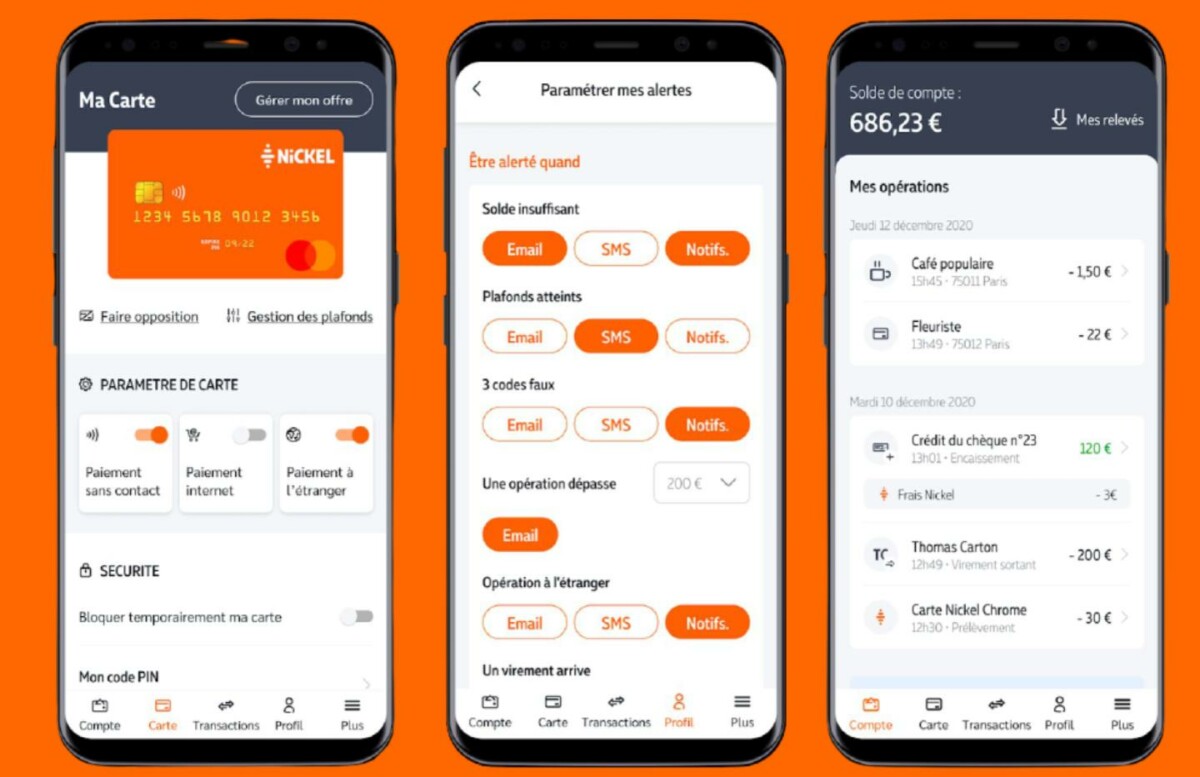

Our Opinion on Nickel’s Mobile App

Like any good neobank, Nickel equipped itself early on with a functional and exclusive app that is not a web-app. Even though it remains simple in its presentation, mainly adopting the bank’s orange, black and white color scheme, it gains in readability and fluidity and is rarely at fault.

On the current account page, the display of expenses is rather clear and well hierarchical thanks to an effective categorization of expenses with visuals corresponding to each type of purchase. There’s even a rather precise timestamp, a specificity not so common on this type of application, well done! In addition to payment or transfer notifications, it is possible to fully set your alerts (insufficient balances, ceilings reached, etc.) whether by notification, email, or even SMS.

However, the non-support of mobile payments via Google Pay or Apple Pay is regrettable.